Teaching children the value of managing money

At what age is it proper to start to talk about finances and the value of money with your children? Should you talk about it at all? How much or little of it is appropriate to let your children manage at what age?

Do you want your children to live in financial abundance? Make sure that you know your own subconscious beliefs about money before trying to impact your younglings.

Make it a subject to research at home

When I started learning about personal development, and devoting myself to becoming the best version of me that I can be, I started setting goals. A few of those goals where in the financial area. I’ve gone slow but steadily forward moving from increasing the hourly fee I charge for my consultancy business to becoming debt free and learning about and creating passive income.

I threw myself into understanding money, how to earn it, keep it and make it grow. It’s been like going back to school but immeasurably more fun since this time I have strong reasons for learning. Everything I’ve learnt has led to even more areas to explore and to dive deeper into. As I’ve begun to see the real life value of understanding this area I’ve felt an increasing frustration of not having learnt about this before. Why isn’t this subject taught at elementary school?

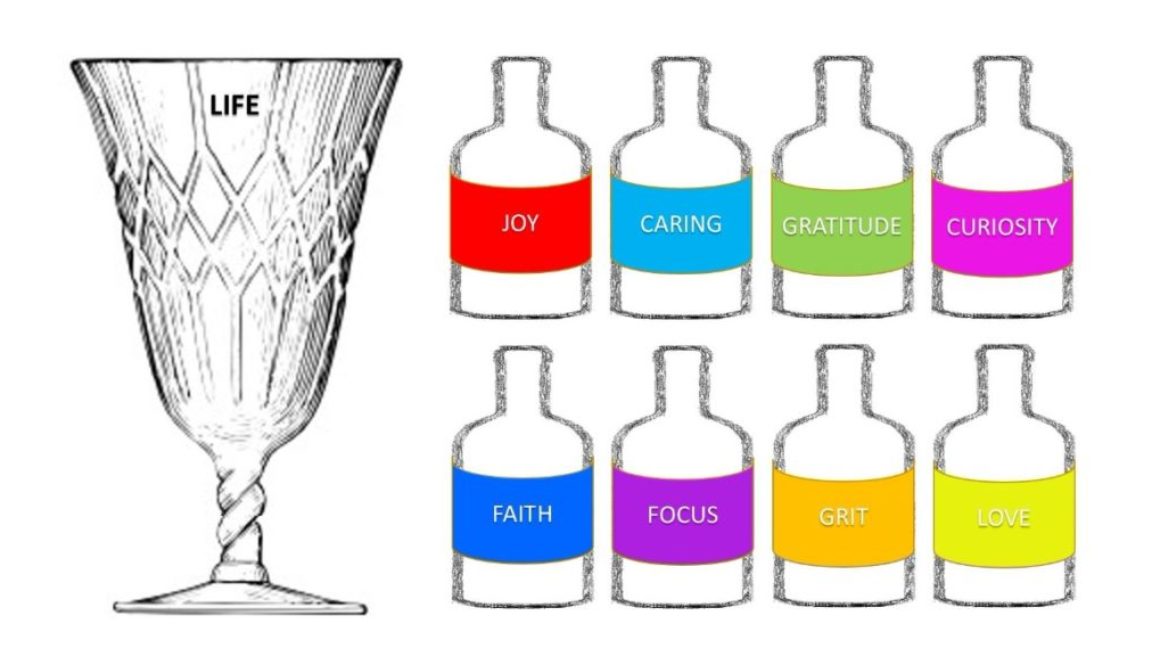

I decided to make money and financial abundance a subject that we should explore at home. I wanted to create a structure for my own learning as well as for my kids’ and I began with defining a number of categories to investigate with my children.

Categories regarding money to research with my kids:

- Mindset about money – Abundance and generosity

- Financial literacy – getting comfortable talking in terms of money

- The value of money and “Need vs Want”

- Self-reliance – responsibility and the ability to plan

- Creating, keeping and making money grow

Learning about the value of money

One of categories we explored early on was around The value of money. At what price is the price considered high or low? Who and what decides what the price should be and what is the actual price for different things?

My girls has gotten an allowance since they were old enough to reach the cashier at the store. It’s been a very small amount and we’ve given it to them weekly. A month is an eternity for small children and since their brains haven’t developed enough to judge consequences properly we thought a weekly amount would be best. Otherwise I think they’d spend all the money at once and then spend the rest of the month nagging us for when the next allowance was due.

In the beginning they could spend their allowance on whatever they wanted. We spent time in the store looking at the price tags and helping out with the math. “I want this!”, “Okey Sweetie, can you afford it?”. As they were growing older they started reflecting on how different the prices were and they started asking “Is this expensive or cheap?”. There were some interesting conversations about if they thought it was worth the price or not. Getting 5 pieces of chocolate versus the comic book with the puzzles and the toys… what to do what to do??..

We learnt that a price can be high for one person but low to another depending on how much you want it and how available the item is. If you can’t find that specific football card in any store close to home then it might be worth a higher price once you get to go to the store in the city.

Learning about supply and demand

Every summer there is a festival close to where we live. For a day the entire park, just meters from our apartment, is filled with people having a good time. There are live bands playing music and food tents selling fast food. Every year the festival draw street performers and small scale entrepreneurs looking to make some profit on the crowd that has gathered.

One year our daughters decided they wanted to try their luck and they asked for our help in setting up a small booth. They brought all the toys they considered themselves too old to play with anymore, small paper notes to write the prices on and on our suggestion a box to keep the money in. Apart from toys we also went to the store and bought a large bag of small individualized candy packs. The price for the entire bag was pretty expensive to our young entrepreneurs and they weren’t all that happy about lending the money to be able to buy it.

They soon realized that the small packs of candy was a gold mine. Kids drawn to the table, by all the toys, were off course immediately asking their parents if they could have some candy. The individual packs sold at a really good price since this was the only place in all the park that sold candy.

As the day progressed they got more and more into sales and shifted from standing timidly behind the table to targeting people walking by with questions and promoting the merchandise.

Replay the day and take reinforce the lessons

One of our most important jobs as parents, I believe, is to track our children’s progress and learning and make it visible and known to them. Realizing that you now know more or can do something you couldn’t before are building blocks for self-esteem and it nurtures the will to learn even more.

Knowledge has a way of sneaking up on you without heralding its presence. If you don’t keep track on your progress you might risk missing it altogether. I use a journal to keep track on my own progress and I revisit chapters from earlier months and years continuously to reflect on possible growth and development. One way to help our kids to recognize their new skills is to replay the day and talk through the things that has happened.

When our girls were done with their first entrepreneurial effort we helped them summarize and reflect. They paid us back the price for the initial investment and calculated their end results. They did a nice profit and we reflected on the day. How did they decide on the sell-price for different things? Was there any bargaining during the day? Was it easy to get customers? What was the actual profit? What made it possible to sell the candy at such a higher price than what they invested in the first place? How did it feel to sell? What was the total experience of the day?

Make a plan for your family’s skillset within the financial area

What areas within finances would you like to learn more of for yourself? Is it keeping a ledger, making a budget, exploring online marketing or even trading with stocks? What concepts could benefit your children? Take some time to reflect on what small experiments you could run together to start teaching them and yourself about one of the more potent sources of influence and independence.

See future posts for more ideas about teaching children about earning, keeping and making money grow.